|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

When You Should Refinance Mortgage: Key Considerations and Timely InsightsRefinancing your mortgage can be a financially savvy move under the right circumstances. By understanding the optimal times to refinance, homeowners can save money, reduce their interest rates, or alter their loan terms to better suit their current financial situation. Understanding Mortgage RefinancingRefinancing involves replacing your existing mortgage with a new one, often with different terms. This can lead to reduced monthly payments, a shorter loan term, or even tapping into your home's equity. Benefits of Refinancing

Ideal Times to Consider RefinancingInterest Rate ChangesIf current interest rates are at least 1% lower than your existing rate, refinancing might be beneficial. It can lead to substantial savings over time. Improved Credit ScoreA better credit score can qualify you for lower rates. If your score has improved since you took out the original loan, consider refinancing. Length of Stay in HomeIt's typically advantageous to refinance if you plan to stay in your home long enough to recoup the closing costs through monthly savings. Potential Downsides to RefinancingWhile refinancing can be beneficial, it's essential to consider the costs involved, such as closing fees, and whether they outweigh the potential savings.

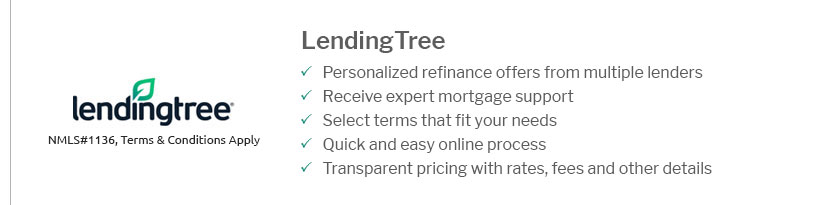

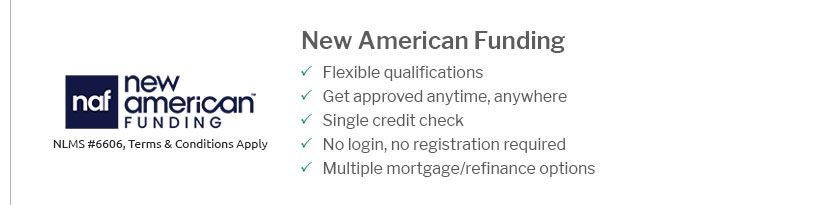

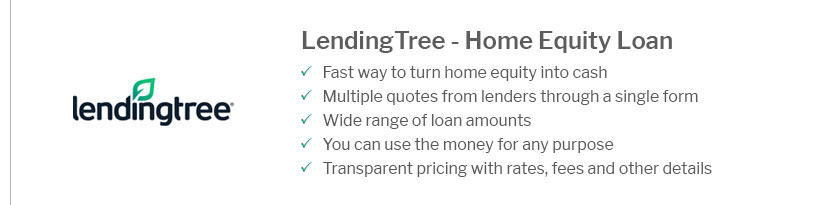

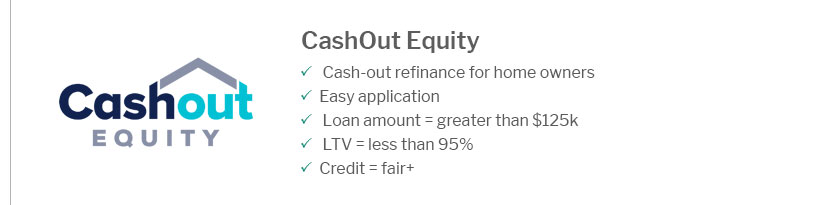

For more detailed guidance on refinancing options, explore home loan refinance specials available to fit your needs. FAQ on Mortgage Refinancing

https://listerhill.com/blog/2020/11/when-you-should-refinance-your-mortgage-rule-of-thumb

When interest rates are low, it's usually a good time to consider refinancing. It's a good rule to refinance if you can reduce your interest rate by at least 1% ... https://www.ramseysolutions.com/real-estate/is-a-mortgage-refinance-right-for-you?srsltid=AfmBOor55Ukt_oGQL2o3tPfsCnJseKO_PQq9CanixkymMYWJc5zkflq6

Refinancing your mortgage is usually worth it if you're planning to stay in your home for a long time. That's when a shorter loan term and lower interest rates ... https://www.cbsnews.com/news/signs-you-should-refinance-your-mortgage-now/

Most economists recommend waiting for a mortgage refinance rate that's a full point lower than your current one before acting. Today's mortgage ...

|

|---|